ITEM No.65:In case you are engaged in a speculative activity. 64: If you are not required to maintain books of accounts in respect of business or profession. In this part fill in the details of the profit and loss account for FY 2018-19, in case books of accounts are not required to be maintained, then fill up the items 61,62,63,and 64 of part-A of P&L.

In this particular part, you need to fill up the details of the Trading account for financial year 2018-19, in case the books of accounts are not required to maintain, then fill up the details in items 61,62,63 or 64 of part -A of P&L. In case you are not required to maintain the books of accounts then fill up the item no.61 or 62 or 63 or 64 of part A - P&L, whichever is applicable.

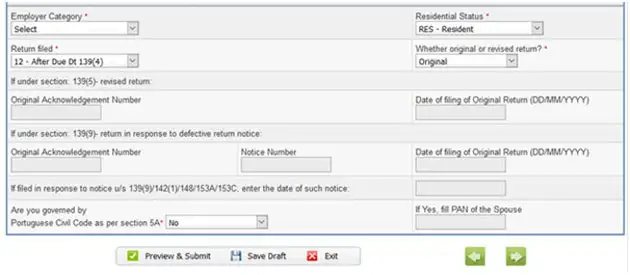

In this part details of the manufacturing account for the financial year 2018-2019 need to be filled. In case the regular books of accounts are not maintained,then fill up the summary details sought at part 6. In this part, please fill in the details of the balance sheet items as on 31st march,2019 in the given format. If liable to audit under other act then mention the name of such act and other relevant informationĮnter the name of business,business code and description of business and other relevant information in PART A as under Balance Sheet Whether assessee is located in an international financial centre (IFSC) and derives income solely in convertible foreign exchange?Īre you liable u/s 44AA,44AB,If yes then provide the information required.Īre you for audit u/s 92E If yes then provide the required information. In case of a non resident whether you have a Permanent Establishment(PE) in India? Whether unlisted equity shares were held by you at any time during the previous year? Whether you held the position of a director in a company at any time during the previous year? Whether this return was filed by a representative assessee. Residential Status in India of both individuals and HUFĭo you want the benefit to be claimed u/s 115HĪre you governed by the civil code of potuguese as per section 5A. If the form is filed in response to a notice, then please enter the Unique Number Date of such notice or Order. If revised/defective/modified then enter Receipt no. It contains information like First name,Middle name,Last name,PAN,Address,Date of birth,Aadhar number,Mobile number, Email id etc. PART A:General information Personal information:

0 kommentar(er)

0 kommentar(er)